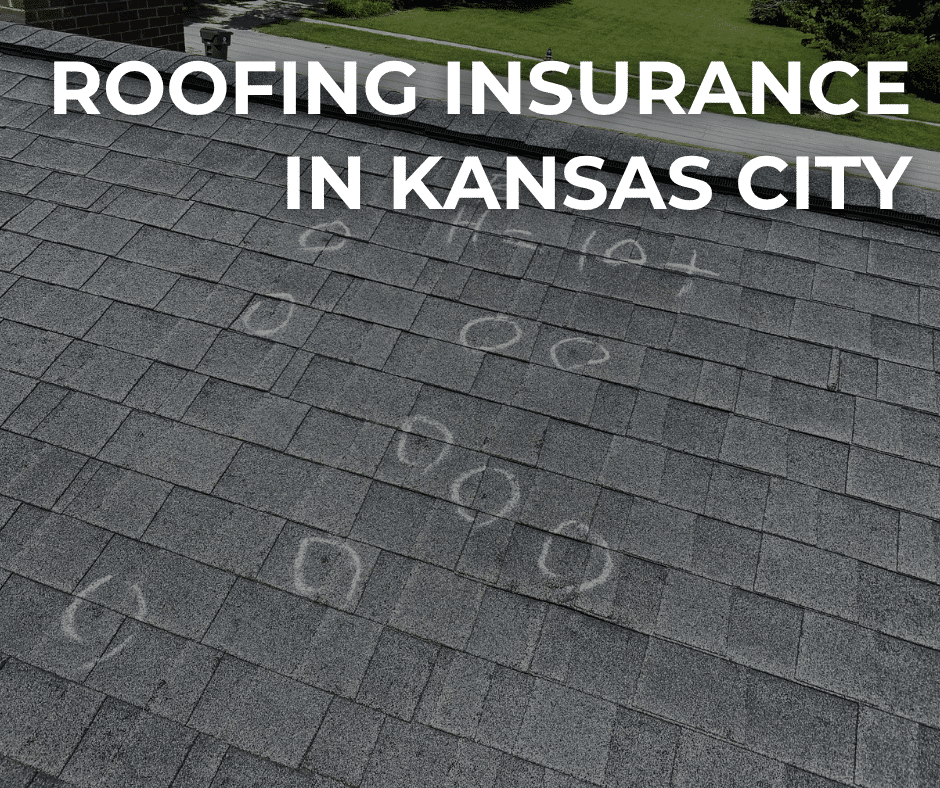

Roofing insurance in Kansas City is changing faster than ever. Many homeowners are finding that their policies no longer cover as much as they used to, and that could mean thousands of dollars out of pocket after the next big storm.

From percentage-based deductibles to confusing ACV vs. RCV payouts, these changes can catch Kansas City homeowners off guard. Here’s what you need to know to protect your home, your roof, and your wallet.

How Roof Age Affects Homeowners Insurance Coverage

Your roof’s age plays a major role in your insurance coverage and premium. As roofs get older, they become more susceptible to leaks, water damage, and storm wear — and insurance companies have started tightening their rules.

- Older roofs may only be covered for Actual Cash Value (ACV) — meaning depreciation is deducted from your payout.

- Some insurers deny coverage for roofs over 15–20 years old or require a full inspection before renewing a policy.

- Newer roofs often qualify for better coverage and lower deductibles.

Learn how to navigate your roof insurance claim here: Roof Insurance Claim Guide – Pyramid Roofing KC

New Insurance Age Limits and Depreciation Clauses

One of the biggest changes in roofing insurance policies involves how age affects reimbursement. In the past, most Kansas City homeowners enjoyed full replacement cost coverage. Now, more insurers are applying depreciation clauses, reducing payouts for older roofs.

In some cases, if your roof is more than 20 years old, your policy may only cover a fraction of the cost or exclude roof damage entirely. That’s why regular inspections and documentation are critical for maintaining coverage.

Can a New Roof Lower Your Homeowners Insurance Premium?

Installing a new roof can reduce your insurance premiums by 5% to 35%. That’s because new roofing materials reduce the risk of weather damage, leaks, and claims.

To maximize your potential savings:

- Use impact-resistant shingles (Class 4) to qualify for discounts

- Notify your insurer after replacing your roof

- Ask about new policy options for weather-resistant materials

A high-quality, professionally installed roof not only protects your home but can also pay off through long-term insurance savings.

Does Roofing Material Impact Insurance Rates?

Absolutely. The type of roofing material you choose can influence both coverage and cost.

- Asphalt shingles are the most common, but may have higher premiums.

- Metal roofs and synthetic roofing systems offer greater durability and weather resistance, often leading to lower premiums.

- Tile or composite roofs may qualify for additional discounts due to longevity and lower replacement frequency.

Insurers prefer materials that stand up to Kansas City’s hailstorms, heavy rain, and high winds, making durable roofs a smart investment.

What Homeowners in Kansas City Should Do Next

To stay ahead of roofing insurance changes:

- Schedule a professional roof inspection to assess condition and age.

- Review your policy for ACV vs. RCV coverage and age restrictions.

- Ask your insurance agent about discounts for new roofs or impact-resistant materials.

- Keep records of all maintenance and repairs.

Taking these steps now can prevent surprise expenses later — especially during Kansas City’s severe weather season.

Protect Your Home with Pyramid Roofing KC

At Pyramid Roofing, we’ve helped Kansas City homeowners navigate roofing insurance claims and coverage changes for over 30 years. Our certified team provides free inspections, insurance guidance, and quality roof replacements that meet the latest industry standards.

Call 816-966-1101 or

Schedule your free roof inspection online

Protect your home. Protect your investment. Pyramid Roofing KC has you covered.